This course will examine state and local tax laws prevalent in the United States today. The course will consider the historical progression of state and local taxation, the power of states to tax (and the limitations on that power), and planning strategies for minimizing the impact of state and local taxation. Discussions will focus on income taxes, sales taxes, and property taxes.

Multistate Taxation

Taught in English

Some content may not be translated

2,547 already enrolled

Course

Gain insight into a topic and learn the fundamentals

Instructor: Matthew Hutchens

(26 reviews)

Recommended experience

Skills you'll gain

- Understand the limitations on a state's taxing power.

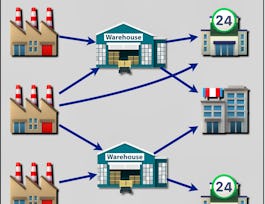

- Calculate how a multistate business should allocate and apportion income among the states where it conducts business.

- Determine when a taxpayer is subject to the jurisdiction of a taxing state.

- Understand the most common types of taxes imposed by state and local governments.

- Understand other basic issues related to income; sales; and property taxes.

Details to know

Add to your LinkedIn profile

36 quizzes

See how employees at top companies are mastering in-demand skills

Earn a career certificate

Add this credential to your LinkedIn profile, resume, or CV

Share it on social media and in your performance review

There are 8 modules in this course

In this module, you will be introduced to your instructor, the course, and to multistate taxation in general. Specifically, you will learn about the most common types of taxes used by state and local governments, the limitations on a state's ability to tax, and the current revenue challenges facing state and local governments.

What's included

5 videos8 readings3 quizzes1 discussion prompt1 plugin

In this module, we will discuss the limitations that the U.S. Constitution and Congress can place on a state's taxing power. Our discussion will primarily focus on the Due Process Clause and the Commerce Clause. We'll also take a closer look at the Commerce Clause's substantial nexus requirement.

What's included

4 videos2 readings5 quizzes

In this module, we will discuss sales and use taxes, which are typically excise taxes imposed on retail transactions to the ultimate end-user of a product. We will also discuss some of the various exemptions from the retail sales tax that states offer. And, we will look at the current sales tax landscape after the U.S. Supreme Court's recent ruling in Wayfair v. South Dakota.

What's included

6 videos7 readings5 quizzes

In this module you will be introduced to how states tax income. We will discuss the history and development of state individual income taxes. We will then turn to how state's utilize the Internal Revenue Code as a head start for their own tax laws. Then we will learn about the two bases of state taxation, residency and source. And, how taxpayers may be eligible for a credit for taxes paid to other states.

What's included

6 videos7 readings7 quizzes

In this module we will be introduced to corporate state income taxes and their history. We will also learn about the most important piece of federal legislation regarding state income taxation, Public Law 86-272. Finally, we will walk through the typical corporate income tax formula used by states to compute state taxable income and tax.

What's included

4 videos4 readings3 quizzes

In this module we will discuss the general rules for allocation and apportionment. This includes differentiating between business (i.e., apportionable) and nonbusiness (i.e., allocable) income. We will also learn how to compute apportionment factors.

What's included

3 videos3 readings4 quizzes

In this module we will learn about the different filing return filing methods (separate, consolidated, and combined) used by states for multi-entity corporate taxpayers. As a part of that discussion, we will discuss the unitary business rule and the constitutional limitations on certain return filing methods. We will then turn to discussing specialized apportionment issues surrounding combined (unitary) tax filing methods.

What's included

4 videos5 readings5 quizzes

In this module we will learn about property taxes. We will discuss the history and development of property taxes. How property taxes are computed. And, common state constitutional limitations on property taxes.

What's included

5 videos5 readings4 quizzes1 discussion prompt1 plugin

Instructor

Recommended if you're interested in Business Essentials

Google Cloud

Google Cloud

Google Cloud

Coursera Project Network

Get a head start on your degree

This course is part of the following degree programs offered by University of Illinois at Urbana-Champaign. If you are admitted and enroll, your coursework can count toward your degree learning and your progress can transfer with you.

Why people choose Coursera for their career

Learner reviews

Showing 3 of 26

26 reviews

- 5 stars

88.46%

- 4 stars

11.53%

- 3 stars

0%

- 2 stars

0%

- 1 star

0%

New to Business Essentials? Start here.

Open new doors with Coursera Plus

Unlimited access to 7,000+ world-class courses, hands-on projects, and job-ready certificate programs - all included in your subscription

Advance your career with an online degree

Earn a degree from world-class universities - 100% online

Join over 3,400 global companies that choose Coursera for Business

Upskill your employees to excel in the digital economy

Frequently asked questions

Access to lectures and assignments depends on your type of enrollment. If you take a course in audit mode, you will be able to see most course materials for free. To access graded assignments and to earn a Certificate, you will need to purchase the Certificate experience, during or after your audit. If you don't see the audit option:

The course may not offer an audit option. You can try a Free Trial instead, or apply for Financial Aid.

The course may offer 'Full Course, No Certificate' instead. This option lets you see all course materials, submit required assessments, and get a final grade. This also means that you will not be able to purchase a Certificate experience.

When you purchase a Certificate you get access to all course materials, including graded assignments. Upon completing the course, your electronic Certificate will be added to your Accomplishments page - from there, you can print your Certificate or add it to your LinkedIn profile. If you only want to read and view the course content, you can audit the course for free.

You will be eligible for a full refund until two weeks after your payment date, or (for courses that have just launched) until two weeks after the first session of the course begins, whichever is later. You cannot receive a refund once you’ve earned a Course Certificate, even if you complete the course within the two-week refund period. See our full refund policy.